Where deep industry knowledge meets user-centered design.

ready to meet you

FAQ

What makes a fintech UX expert different from a regular UX designer?

A fintech UX expert possesses deep domain knowledge of regulatory landscapes (like KYC and AML), ensuring that strict compliance requirements are woven seamlessly into the user journey without creating friction. Unlike a generalist, they understand the psychology of money, designing specifically to build institutional trust and reduce user anxiety during high-stakes transactionbs. Furthermore, they specialize in visualizing dense financial data through a tailored fintech design system, transforming complex analytics into clear, actionable insights that standard UI patterns often fail to address.

How to design a fintech app?

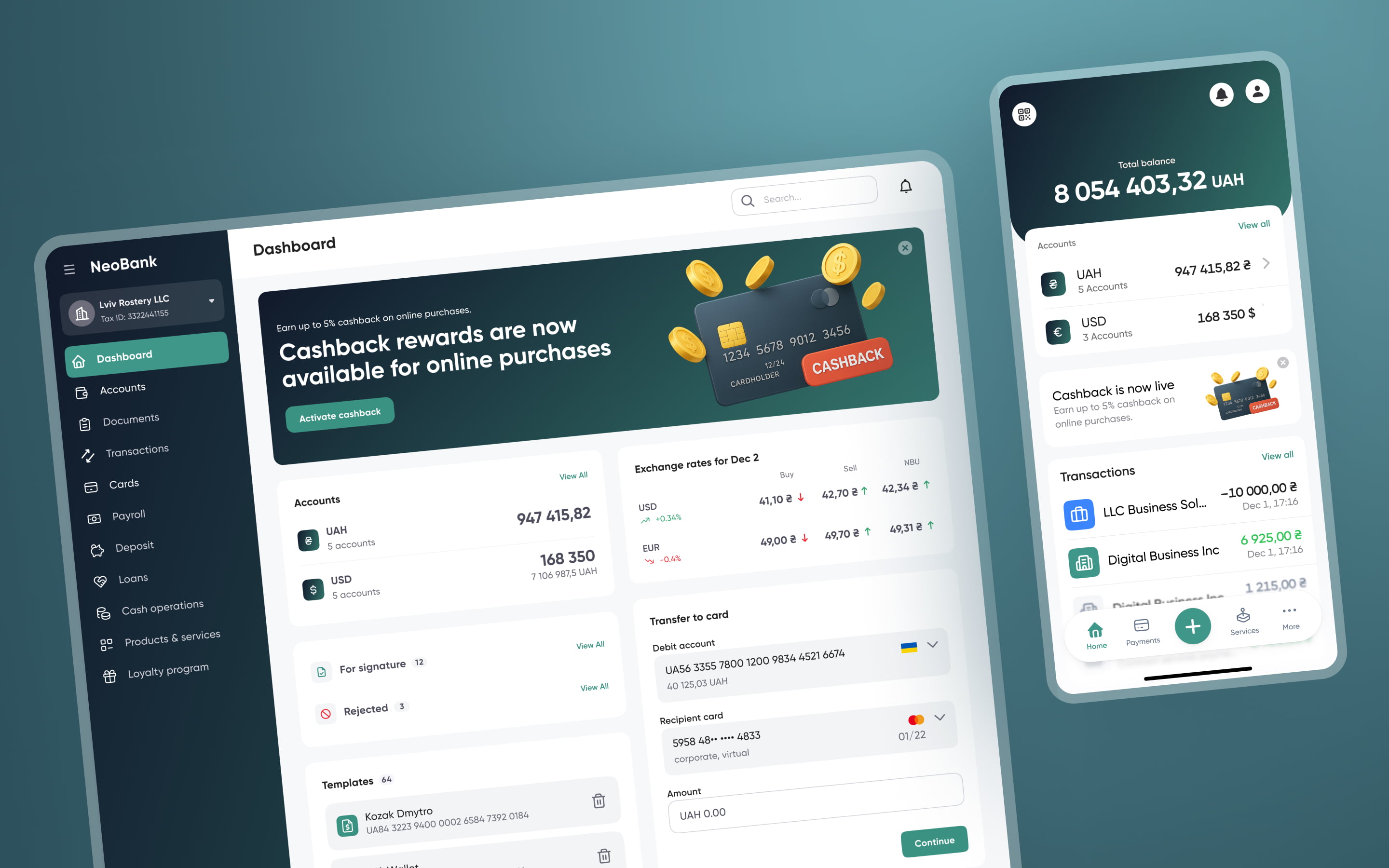

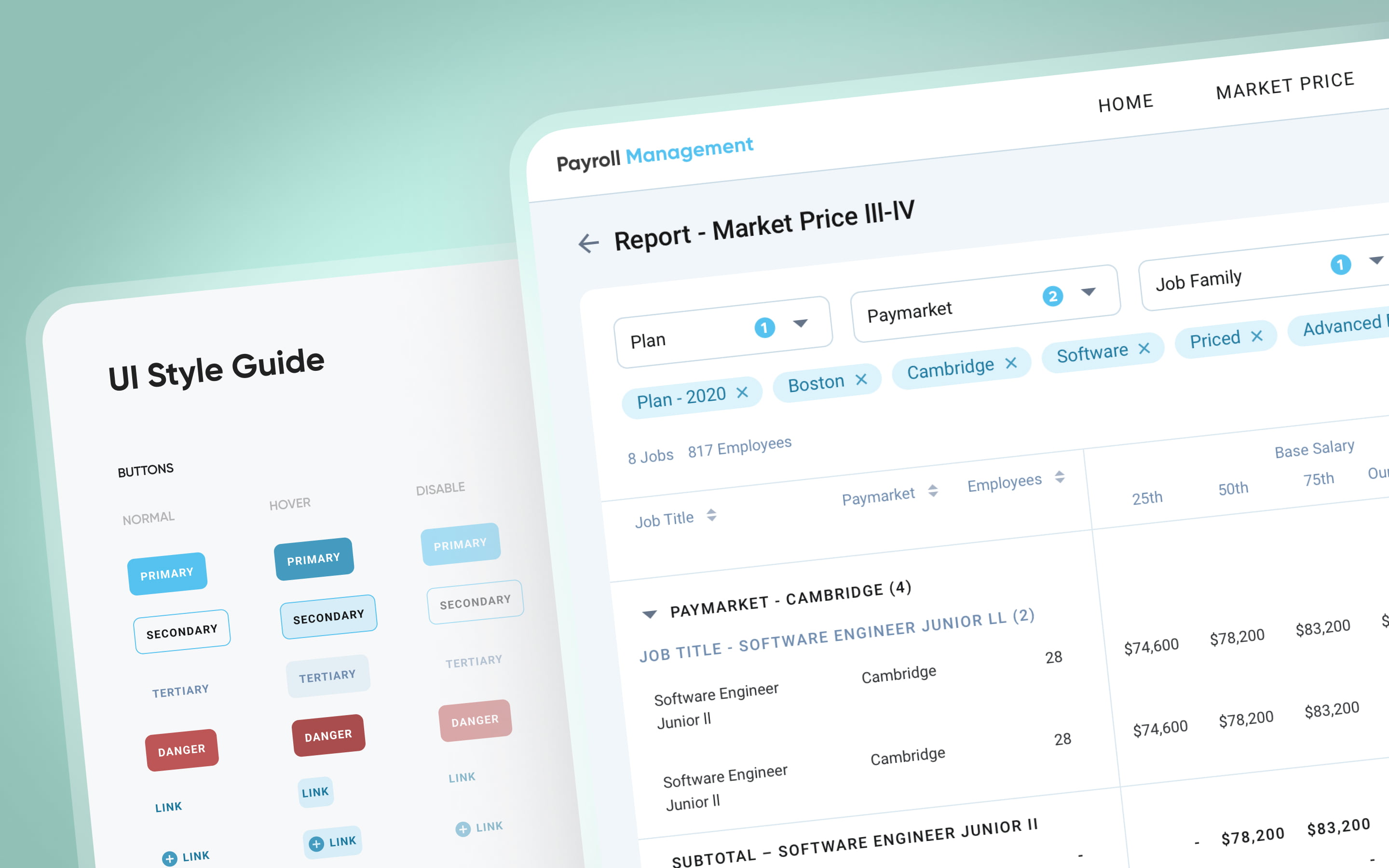

Designing a successful fintech app requires moving beyond basic functionality to create a specialized trust-building ecosystem. A consultant guides this by first mapping complex regulatory requirements (KYC/AML) against user needs to ensure compliance doesn't kill conversion rates. The process then moves to creating a scalable fintech design system, ensuring that every interaction – from transferring funds to viewing analytics – is consistent, secure, and reduces the cognitive load on the user.

What are the recent fintech UX design trends?

The most impactful trend is hyper-personalization, where AI is used to transform raw transaction data into actionable financial advice, shifting apps from passive tools to active financial partners. Additionally, "invisible security" is becoming the standard, utilizing behavioral biometrics to authenticate users without friction, alongside gamification mechanics that encourage healthy financial habits through progress tracking and rewards. A consultant helps you implement these trends not just as "features," but as retention engines that increase customer lifetime value.

What makes a bank website design good?

A high-performing bank website strikes a precise balance between institutional security and friction-free navigation, ensuring users feel safe without getting stuck in complex menus. It prioritizes a customer-centric Information Architecture that organizes dense financial data into clear, actionable dashboards, which directly correlates to lowering customer support ticket volume. Ultimately, good design leverages a scalable fintech design system to ensure accessibility and consistency, transforming the website from a static brochure into a high-converting, fully functional digital branch.

How to choose a fintech mobile app design agency?

Select an agency that prioritizes regulatory compliance (like KYC/AML) as highly as aesthetics, ensuring your product is not just visually stunning but legally secure from day one. Look beyond their portfolio's surface appeal for evidence of measurable business impact, such as specific metrics on how they reduced onboarding drop-off or increased transaction frequency for past clients. Finally, ensure they build using a robust fintech design system, which guarantees that your app’s infrastructure is scalable enough to grow from a startup MVP to an enterprise-grade ecosystem without requiring a complete rebuild.

Do you offer fintech app development, or only fintech product design?

Yes, we offer full-cycle implementation, taking your product from initial strategy and design all the way through to a fully deployed, secure application. This ensures that the nuance of our fintech UX design – specifically the complex regulatory and security workflows – is preserved perfectly in the final code.